In the previous post we learned how to design trading strategies using the beta-binomial conjugate distribution. Can we design trading strategies using the gamma-Poisson conjugate distribution? This post will show an example of a trading strategy.

Model

- Objective: simulate the average number of increases over a period of time

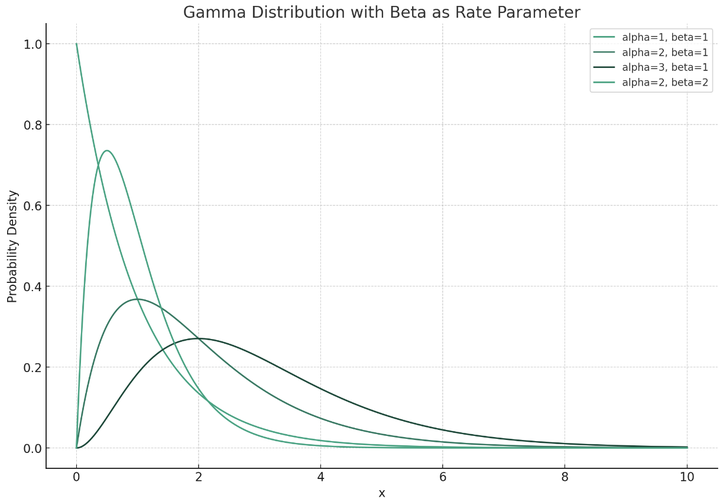

- Prior distribution: gamma distribution, the following is the distribution function of gamma distribution:

Below are the images of the gamma distribution function with different parameters::

It can be seen that the domain of the gamma distribution is [0, +$\infty$], which means that we can no longer choose to study the parameter $\theta$, which is a 0 to 1 probability of increase. We can study the average number of increases $\lambda$ over a period of time. This is why we need to choose the Poisson distribution to calculate the likelihood.

It can be seen that the domain of the gamma distribution is [0, +$\infty$], which means that we can no longer choose to study the parameter $\theta$, which is a 0 to 1 probability of increase. We can study the average number of increases $\lambda$ over a period of time. This is why we need to choose the Poisson distribution to calculate the likelihood.

- Poisson distribution likelihood function:

Poisson distribution has only one parameter $\lambda$, which we define as the number of increases in a period of time.

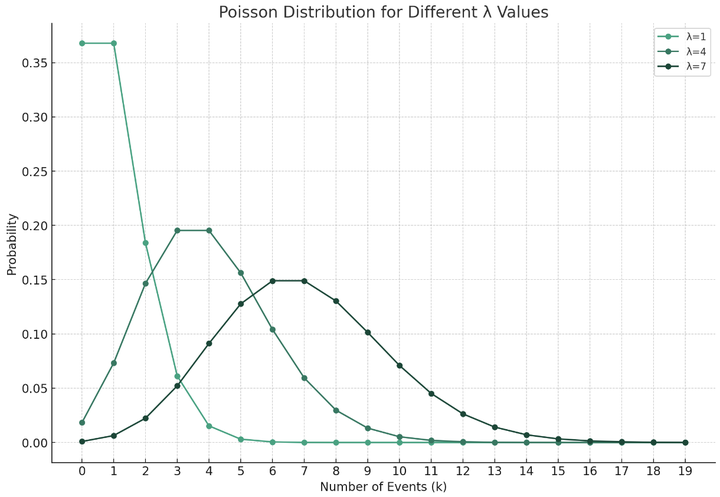

The following is the probability density function of Poisson distribution:

$$L(\lambda; k) = \frac{e^{-\lambda} \lambda^k}{k!}$$

The following is the probability density image of Poisson distribution:

It can be seen that the Poisson distribution is a discrete distribution, which can be used to simulate discrete values such as the number of increases.

If we assume that the number of increases in each period of time is independent of each other, we can use the Poisson likelihood function.

The following is the likelihood function of the Poisson distribution:

$$L(\lambda; x_1, x_2, \ldots, x_n) = e^{-n\lambda} \lambda^{\sum_{i=1}^{n}x_i} \prod_{i=1}^{n} \frac{1}{x_i!} $$

It can be seen that the Poisson distribution is a discrete distribution, which can be used to simulate discrete values such as the number of increases.

If we assume that the number of increases in each period of time is independent of each other, we can use the Poisson likelihood function.

The following is the likelihood function of the Poisson distribution:

$$L(\lambda; x_1, x_2, \ldots, x_n) = e^{-n\lambda} \lambda^{\sum_{i=1}^{n}x_i} \prod_{i=1}^{n} \frac{1}{x_i!} $$ - Posterior distribution After we have the prior distribution and likelihood function, we can calculate the posterior distribution, which is as follows: $$p(\lambda | x_1, x_2, \ldots, x_n; \alpha', \beta') = \frac{{\beta'}^{\alpha'}}{\Gamma(\alpha')} \lambda^{\alpha' - 1} e^{-\beta' \lambda} $$ $$\alpha' = \alpha + \sum_{i=1}^{n} x_i,\beta' = \beta + n$$ It can be found that the posterior distribution is also a gamma distribution, and the $\alpha$ and $\beta$ of the posterior distribution can be directly obtained through the information of the observed samples, which provides great convenience for the calculation.

Application Examples

-

Long cycle The long cycle determines the gamma distribution prior. The unit of the long cycle is hour k. The long cycle sequence is hour k of n days, which is synthesized by 7 * 24 * 60 = 10080 minute k. Then calculate the number of daily increases in 24 hours, {“day1”: 13, “day2”: 6, “day3”: 8….“dayn”: x} Calculate the sample mean and variance to estimate (Moment method, moment estimation) the prior alpha prior and beta prior $\bar{x} = \frac{\alpha}{\beta}$,$s^2 = \frac{\alpha}{\beta^2}$

-

Short cycle The short cycle determines the likelihood function. The unit of the short cycle is minute k. The length of the number cycle n may not be equal to that of the long cycle. The range of the number of short-term rises should preferably include the range of the number of long-term rises, that is, $\lambda_{long} \subseteq \lambda_{short}$, because if the maximum number of short-term rises is 3 and the maximum number of long-term rises is 12, the posterior probability distribution will definitely move toward a smaller $\lambda$ value, which will cause us to lose some information. So we assume that the maximum number of rises per cycle in such a short cycle is 24, that is, I need n 24 minute k, a total of n * 24 minute K lines. Get the short-term data {“k1”: 13, “k2”: 12, “k3”:9 , …..“kn”:x}

Code simulation and implementation

First, I randomly select 50 samples according to the number of increases range [0,24], and then calculate the mean and variance of this sample.

long_period_data = np.random.randint(0, 25, 50) # 假设每天的最大上涨次数为24

# Calculate mean and variance

mean_long = np.mean(long_period_data)

variance_long = np.var(long_period_data)

# Estimate prior parameters of the gamma distribution

alpha_prior = mean_long**2 / variance_long

beta_prior = mean_long / variance_long

Finally, the prior $\alpha$ and $\beta$ values are calculated using moment estimation. The next step is to simulate short-term data, also using random function sampling.

#Simulate short-term (24-minute) data

short_period_data = np.random.randint(0, 25, size=5) # 假设每24分钟周期的最大上涨次数为24

# Update the posterior distribution parameters

alpha_posterior = alpha_prior + sum(short_period_data)

beta_posterior = beta_prior + len(short_period_data)

Finally, the posterior parameters are calculated according to the formula of the conjugate posterior distribution mentioned above.

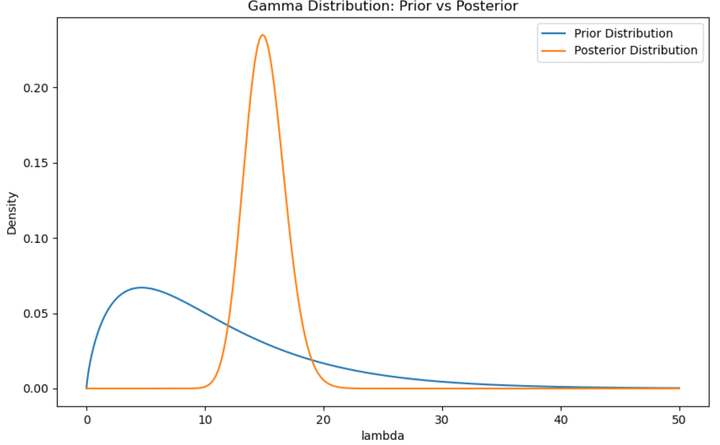

The following is an image comparison:

It can be seen that the mean and mode of the posterior distribution have moved to the right, indicating that the average number of increases observed in the short period may be relatively high, causing the distribution to move to the right.

Comparison of prior and posterior parameters:

It can be seen that the mean and mode of the posterior distribution have moved to the right, indicating that the average number of increases observed in the short period may be relatively high, causing the distribution to move to the right.

Comparison of prior and posterior parameters:

Alpha Prior: 1.7518570171605738, Beta Prior: 0.16190915130874067

Alpha Posterior: 77.75185701716057, Beta Posterior: 5.16190915130874

Case complete code:

import numpy as np

from scipy.stats import gamma, poisson

import matplotlib.pyplot as plt

for i in range(5):

#Simulate long-term data

long_period_data = np.random.randint(0, 25, 50) # Assume that the maximum number of daily increases is 24

# Calculate mean and variance

mean_long = np.mean(long_period_data)

variance_long = np.var(long_period_data)

# Estimate the prior parameters of the gamma distribution

alpha_prior = mean_long**2 / variance_long

beta_prior = mean_long / variance_long

#Simulate short-term data

short_period_data = np.random.randint(0, 25, size=5) # Assume that the maximum number of increases per 24-minute period is 24

# Update the posterior distribution parameters

alpha_posterior = alpha_prior + sum(short_period_data)

beta_posterior = beta_prior + len(short_period_data)

# Output results

print(f"Alpha Prior: {alpha_prior}, Beta Prior: {beta_prior}")

print(f"Alpha Posterior: {alpha_posterior}, Beta Posterior: {beta_posterior}")

# Create prior and posterior distributions for the gamma distribution

prior_dist = gamma(alpha_prior, scale = 1/beta_prior)

posterior_dist = gamma(alpha_posterior, scale = 1/beta_posterior)

lambda_samples = np.random.gamma(alpha_posterior, 1/beta_posterior, 1000)

# Generate gamma distribution probability density function (PDF) data

x = np.linspace(0, 50, 100000)

y_prior = prior_dist.pdf(x)

y_posterior = posterior_dist.pdf(x)

# Draw the image

plt.figure(figsize=(10, 6))

plt.plot(x, y_prior, label='Prior Distribution')

plt.plot(x, y_posterior, label='Posterior Distribution')

plt.title('Gamma Distribution: Prior vs Posterior')

plt.xlabel('lambda')

plt.ylabel('Density')

plt.legend()

plt.show()

Strategy Backtesting

Strategy Logic

Logic 1: After obtaining the parameters of the posterior distribution, calculate the posterior mode:

$$\alpha_{mode} = \frac{\alpha_{post}-1}{\beta_{post}} $$Use this posterior mode as an estimate of the number of rises in the next short period. If $\frac{\alpha_{mode}}{n}>$buy_threshold, it is considered a long signal, otherwise if it is less than sell_threshold, it is considered a short signal. Logic 2: Use the posterior prediction distribution to calculate the posterior probability of the target number of increases:

$$ p(\lambda_{\text{new}} | D) = \int p(\lambda_{\text{new}} | \theta) p(\theta | D) d\theta $$First, the target number of increases $\lambda_{new}$ is generally a number greater than $\frac{n}2$ (because we hope that the number of increases in the next period will be more). Similarly, if this probability is greater than buy_threshold, it is a long signal, otherwise if it is less than sell_threshold, it is a short signal. The following is the python code for this formula:

# Simulate calculus

lambda_space = np.linspace(0,30,1000)

delta_lambda = lambda_space[1] - lambda_space[0]

prob_post = np.sum(poisson.pmf(target_lambda, lambda_space) * gamma.pdf(lambda_space, a=alpha_posterior, scale=1/beta_posterior)) * delta_lambda

Assuming $\lambda_{new}=15$, we can also calculate the probability that the number of increases is greater than 15, that is, the probability of $P(\lambda_{new}>15)$, that is, add up all the probabilities greater than the target value:

post_prop = []

for x_new in np.arange(target_lambda,n,1):

prob_new = np.sum(poisson.pmf(x_new, lambda_space) * gamma.pdf(lambda_space, a=alpha_posterior,

scale=1 / beta_posterior)) * delta_lambda

post_prop.append(prob_new)

post_prop = sum(post_prop)

In actual combat, you can choose different trading logics according to your needs.

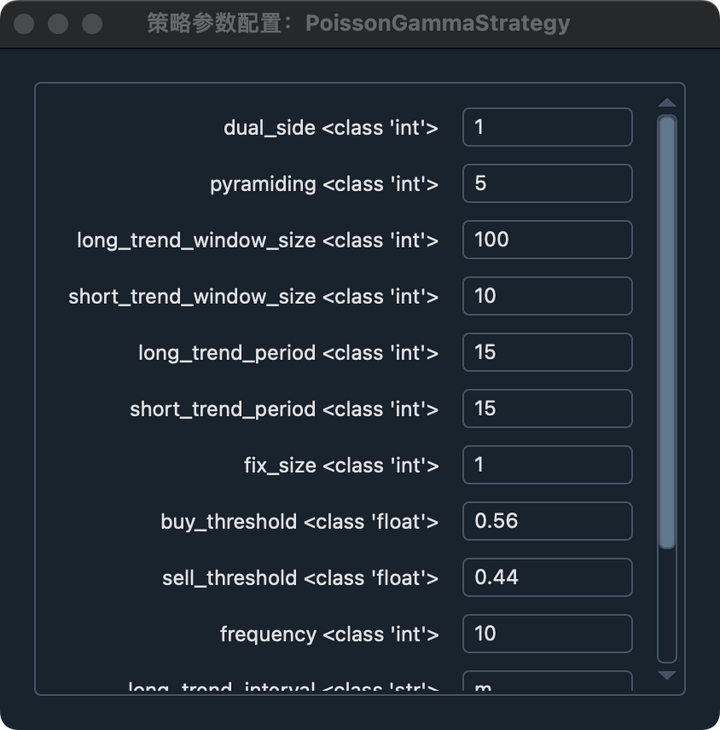

Strategy parameters

- dual_side: whether to open a position in both directions

- pyramiding: maximum number of openings in the same direction

- long_trend_window_size: long period sequence length

- short_trend_window_size: short period sequence length

- long_trend_period: long period granularity,

- short_trend_period: short period granularity

- buy_threshold: long threshold

- sell_threshold: short threshold

- fix_size: the amount of each opening

- frequency: the range of the number of increases

- long_trend_interval:m (m分钟,h小时,d日)

- short_trend_interval:m

Default parameters:

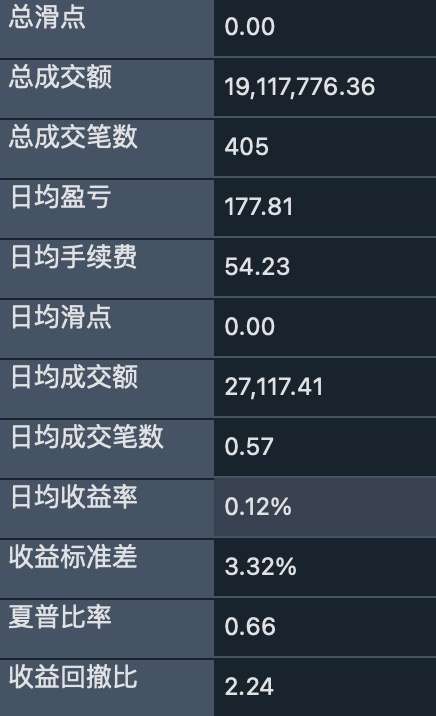

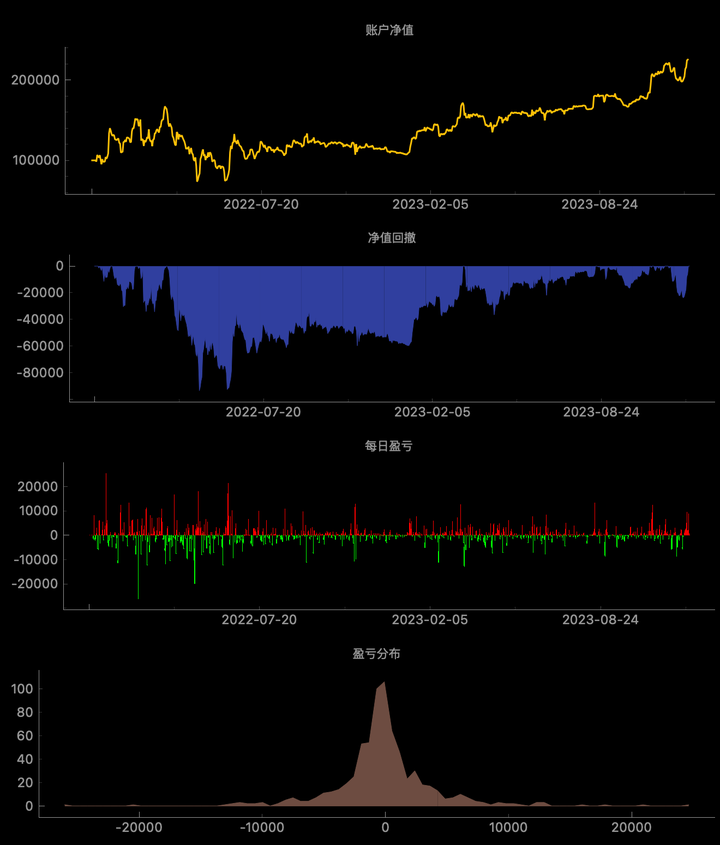

Target: BTCUSD Start date: 2022-1-1 End date: 2023-12-6 Fee rate: 0.002 Funds: 100000

Backtest results

- Strategy curve

Summary

The Bayesian trading strategy using the gamma-poisson conjugate is very flexible. I only show the backtest results of method 1 in the strategy logic. Readers can also build strategies based on the number of times, rather than converting to probability like me. For example, if the number of posterior increases is 15, can I block the reversal market after 15 increases? Everyone is welcome to discuss.

Strategy code

from vnpy_ctastrategy import (

CtaTemplate,

StopOrder,

TickData,

BarData,

TradeData,

OrderData,

BarGenerator,

ArrayManager,

)

import numpy as np

from vnpy.trader.object import Interval

from scipy.stats import gamma, poisson

interval_map = {"m": Interval.MINUTE,

"h": Interval.HOUR,

"d": Interval.DAILY}

class PoissonGammaStrategy(CtaTemplate):

author = "Xuanhao"

prior = 0

pyramiding = 1

frequency = 24

long_trend_window_size = 5

short_trend_window_size = 5

long_trend_period = 1 # 1hour 2hour

short_trend_period = 5 # 5 minutes

long_trend_interval = "m"

short_trend_interval = "m"

fix_size = 1

buy_threshold = 0.55

sell_threshold = 0.45

dual_side = 1

parameters = ["dual_side", "pyramiding", "long_trend_window_size","short_trend_window_size","long_trend_period", "short_trend_period" ,"fix_size", "buy_threshold", "sell_threshold", "frequency", "long_trend_interval", "short_trend_interval"]

variables = ["bayesian_prob"]

def __init__(self, cta_engine, strategy_name, vt_symbol, setting):

super().__init__(cta_engine, strategy_name, vt_symbol, setting)

long_interval = interval_map[self.long_trend_interval]

short_interval = interval_map[self.short_trend_interval]

self.bg_long = BarGenerator(self.on_bar, self.long_trend_period, self.on_long_bar, interval=long_interval)

self.bg_short = BarGenerator(self.on_bar, self.short_trend_period, self.on_short_bar, interval=short_interval)

self.am_long = ArrayManager(self.long_trend_window_size*self.frequency)

self.am_short = ArrayManager(self.short_trend_window_size*self.frequency)

self.priors_inited = False

def on_init(self):

self.write_log("策略初始化")

self.load_bar(10)

def on_start(self):

self.write_log("策略启动")

self.put_event()

def on_stop(self):

self.write_log("策略停止")

self.put_event()

def on_bar(self, bar: BarData):

self.bg_long.update_bar(bar)

self.bg_short.update_bar(bar)

def on_long_bar(self, long_bar: BarData):

self.am_long.update_bar(long_bar)

if not self.am_long.inited:

return

poisson_event = []

for order in range(self.long_trend_window_size):

ups = sum(1 for index in np.arange((order)*self.frequency, (order+1)*self.frequency, 1) if

self.am_long.close_array[index] > self.am_long.open_array[index])

poisson_event.append(ups)

mean = np.mean(poisson_event)

variance = np.var(poisson_event)

## MM estimator

self.alpha_prior = mean ** 2 / variance

self.beta_prior = mean / variance

self.priors_inited = True

def on_short_bar(self, short_bar: BarData):

self.am_short.update_bar(short_bar)

if not self.am_short.inited:

return

if not self.priors_inited:

return

poisson_event = []

for order in range(self.short_trend_window_size):

ups = sum(1 for index in np.arange((order) * self.frequency, (order + 1) * self.frequency, 1) if

self.am_short.close_array[index] > self.am_short.open_array[index])

poisson_event.append(ups)

self.alpha_post = self.alpha_prior + sum(poisson_event)

self.beta_post = self.beta_prior + self.short_trend_window_size

# use posterior mean or mode

self.poster_mean = self.alpha_post/self.beta_post

self.poster_var = self.alpha_post/(self.beta_post)**2

self.poster_mode = (self.alpha_post-1)/self.beta_post

if self.dual_side:

# both long and short

if self.poster_mode/self.short_trend_window_size > self.buy_threshold:

if self.pos >= 0:

if abs(self.pos) < self.pyramiding:

self.buy(short_bar.close_price, self.fix_size)

else:

self.cover(short_bar.close_price, abs(self.pos))

self.buy(short_bar.close_price, self.fix_size)

if self.poster_mode/self.short_trend_window_size < self.sell_threshold:

if self.pos <= 0:

if abs(self.pos) < self.pyramiding:

self.short(short_bar.close_price, self.fix_size)

else:

self.sell(short_bar.close_price, abs(self.pos))

self.short(short_bar.close_price, self.fix_size)

else:

if self.poster_mode/self.short_trend_window_size > self.buy_threshold:

if self.pos >= 0 and self.pos < self.pyramiding:

self.buy(short_bar.close_price, self.fix_size)

if self.poster_mode/self.short_trend_window_size < self.sell_threshold:

if self.pos != 0:

self.sell(short_bar.close_price, self.pos)